Download Scope’s 2021 external vulnerability and resilience report and rankings.

Scope Ratings’ methodology for assigning sovereign credit ratings is based on five analytical rating pillars, one of which is “external economic risk”, with a roughly 15% weighting in the overall sovereign rating review process[1]The ‘External Economic Risk’ pillar of the Agency’s sovereign rating methodology holds a 10% weight in the overall rating review process via the sovereign quantitative model, the Core Variable … Continue reading. As this weighting suggests, external risk is highly significant in the prediction of sovereign default during global economic and financial-sector downturns.

Since onset of the Covid-19 crisis in 2020, Lebanon, Argentina and Zambia have each defaulted on their foreign debt. The risk of further credit events in 2022 is high under more inflationary conditions globally as central banks remove stimulus, with the possibility of further rises of global bond yields. Such circumstances are especially challenging for many developing economies. Unlike mature economies, poor and middle-income countries have less-sophisticated domestic financial systems, burdened by the ‘original sin’ of more limited capacity to issue debt in domestic currencies to a significant-enough domestic investor base. As a result, developing countries remain structurally dependent on external credit, posing debt payment risk when foreign funding becomes more expensive.

Close monitoring of external-sector risk is crucial at this juncture in the economic cycle given ups and downs of the recovery from the Covid-19 crisis and likely volatility in global markets as central banks start normalising policies.

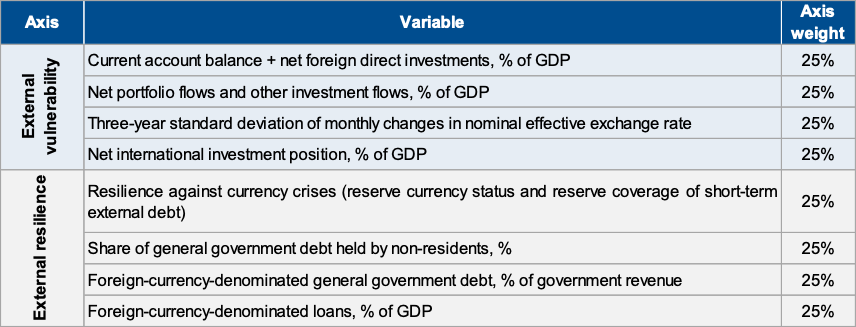

In this article, Levon Kameryan[2]Levon Kameryan, Senior Analyst at Scope Ratings GmbH and co-author of Scope’s annual external risk reports, co-wrote this blog. and I present Scope Ratings’ latest annual external vulnerability and resilience risk assessment framework, published today, evaluating countries’ exposure to external-sector risk under current conditions of high uncertainty. We have expanded this year’s study to cover 95 nations from an original 63 in 2018 and 2020. The framework is based upon eight core indicators (Figure 1) divided along two axes: i) external vulnerability; and ii) external resilience.

Figure 1: External vulnerability and resilience framework (structure)

The framework assumes a minimum-maximum algorithm to determine a score under each of the above eight factors, with this variable-level score ranging from 0.1 (lowest) to 10 (highest). Factor scores are then combined equally weighted to reach axes-level scores of each country under separate vulnerability and resilience axes. A country’s overall score reflects a simple mathematical summation of the two axes-level scores. Source: Scope Ratings GmbH.

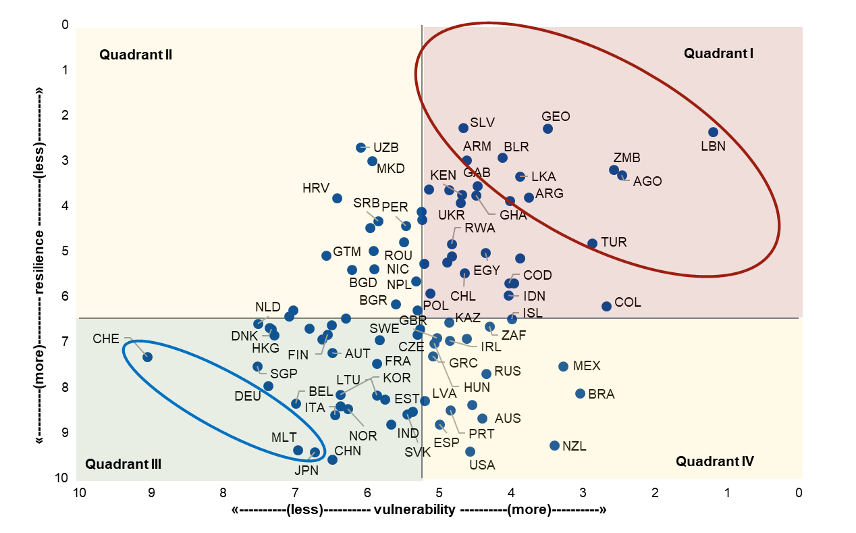

Figure 2 displays, from a bird’s eye perspective, the results of the external vulnerability and resilience framework for 2021 for our 95 evaluated nations. The graphic is divided into four quadrants: Quadrant I. countries that are comparatively vulnerable and comparatively less resilient to external shocks – the highest risk group; II. countries that are less vulnerable to external shocks but also less resilient to one were one to occur; III. those nations that are less vulnerable to crisis and also comparatively resilient in advent of any crisis – the lowest risk group; and IV. countries that may be vulnerable to crisis but resilient should any crisis occur.

Figure 2: External vulnerability and resilience two-axis grid: 2021

The dividing lines between quadrants reflect the median country scores on each of the two (vulnerability and resilience) respective axes across the full 95-country sample. Source: Scope Ratings GmbH.

Under Scope’s external-risk assessment, Lebanon, Zambia and Angola represent this year’s “risky-3” of most vulnerable and least resilient countries globally to external shock. Together with last year’s risky-3 of Georgia (rated BB/Stable), Argentina (unrated) and Turkey (B/Negative), El Salvador, Belarus, Sri Lanka and Armenia also make a top 10 of most at-risk economies internationally. These 10 countries (circled in red under Figure 2, under Quadrant I) share specific characteristics, typically including high foreign-currency exposure and currencies vulnerable during global risk-off phases, current-account deficits and exposure to severe capital outflows, amplified by lesser reserve adequacy and/or significant maturing external debt.

Advanced economies generally receive stronger marks under our evaluation framework (displayed mostly under the safest Quadrant III in Figure 2) as issuers of global reserve currencies and statuses as global safe-haven benchmark issuers. As an example, Switzerland (AAA/Stable), this year’s #1 ranked nation, is a member of 2021’s global “sturdy-3” (circled in Figure 2 in blue) of three most robust nations to external economic risk, alongside Malta (A+/Stable) and Japan (A/Stable). China fell to fourth globally from weaker current account and net portfolio flow dynamics. The 10 least at-risk countries globally also consist of Germany (AAA/Stable), Belgium (AA-/Stable), Singapore (unrated), Italy (BBB+/Stable), Slovenia (A/Stable) and Norway (AAA/Stable).

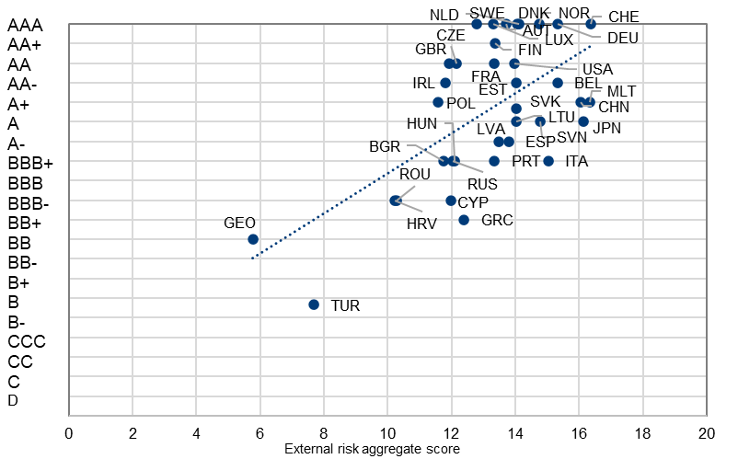

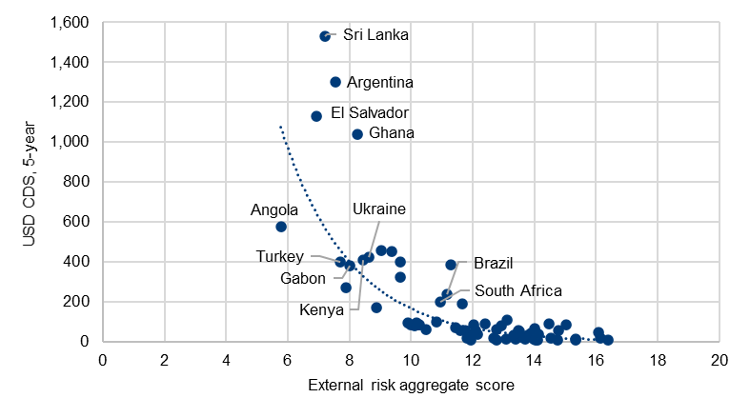

Figure 3 and Figure 4 display our aggregate external risk scoring, aggregated between the framework’s two axes for each country, against Scope’s current sovereign credit ratings as well as against 5-year CDS. In Figure 3, a relationship between the score and the long-term sovereign credit ratings assigned by Scope is illustrated – although there are outliers such as Turkey’s creditworthiness being rated weaker by Scope than risks implied by even the economy’s poor external-risk metrics. The same may be said for peripheral Europe countries, with nations ranking in the middle of Scope’s external-risk ranks but receiving comparatively weaker credit ratings due to vulnerabilities captured under sovereign-rating benchmarks outside of external-sector risk such as high government debt. Figure 4 displays a curvilinear relationship between performance under the external-risk framework and CDS – referencing the importance of close monitoring of external risk in forward-looking appraisal of sovereign default risk.

Figure 3: Scope external risk score (x-axis) vs Scope sovereign foreign-currency long-term ratings (y-axis)

Displayed are the 36 sovereigns that Scope rates publicly (ratings as of 5 November 2021). Source: Scope Ratings GmbH.

Figure 4: Scope external risk score vs USD 5-year CDS, bps

CDS data as of 5 November 2021. All the 95 ranked countries under this report that present the requisite CDS data displayed. Source: Bloomberg, Scope Ratings GmbH.

About the author

Dennis Shen is a macroeconomist and a Director in sovereign ratings with Scope Ratings based in Berlin, Germany. Before he joined Scope in 2017, Dennis was a European Economist with Alliance Bernstein in London. Dennis graduated from the MPA in International Development from the London School of Economics in 2013 and completed undergraduate studies at Cornell University, where he graduated from the College of Engineering in 2007.

References